May 30, 2009

Welcome,

The following is the third in a series of newsletters designed to foster a healthy dialog. I hope you enjoy it and encourage your feedback and discussion.

Take a look at http://www.caswell.org for prior articles, access to resources and information on what I can do for you. If you know someone who would benefit from this piece, please forward it, or just let me know and I'll send it to them directly.

Please drop me a line and let me know your thoughts: ward@caswell.org

Regards,

Ward S Caswell

(617) 304-2689

Virtual Organizations, Real Benefits

This piece visits the evolving concepts of virtual corporations, social networking and cloud computing. It strives to help you and your organization improve efficiency and accelerate response to changing customer needs and economic conditions. Virtual corporations are those with minimal physical presence. Put another way, they don't really exist until there is work to perform. When needed, they bring together the resources to do the job. When the work is finished, they disband those resources until the next project. Social networking refers to a set of internet based programs allowing people with similar interests to form communities for quick, borderless communication. These programs include Facebook, LinkedIn, Twitter, Ning, and others. Cloud computing in this context is defined as leased, off-site computer hardware and software systems. They are usually connected via the internet and have the benefit of outsourced scalability. Combined, these concepts present powerful new tools for your organization to offer better client solutions in less time for less money.

|

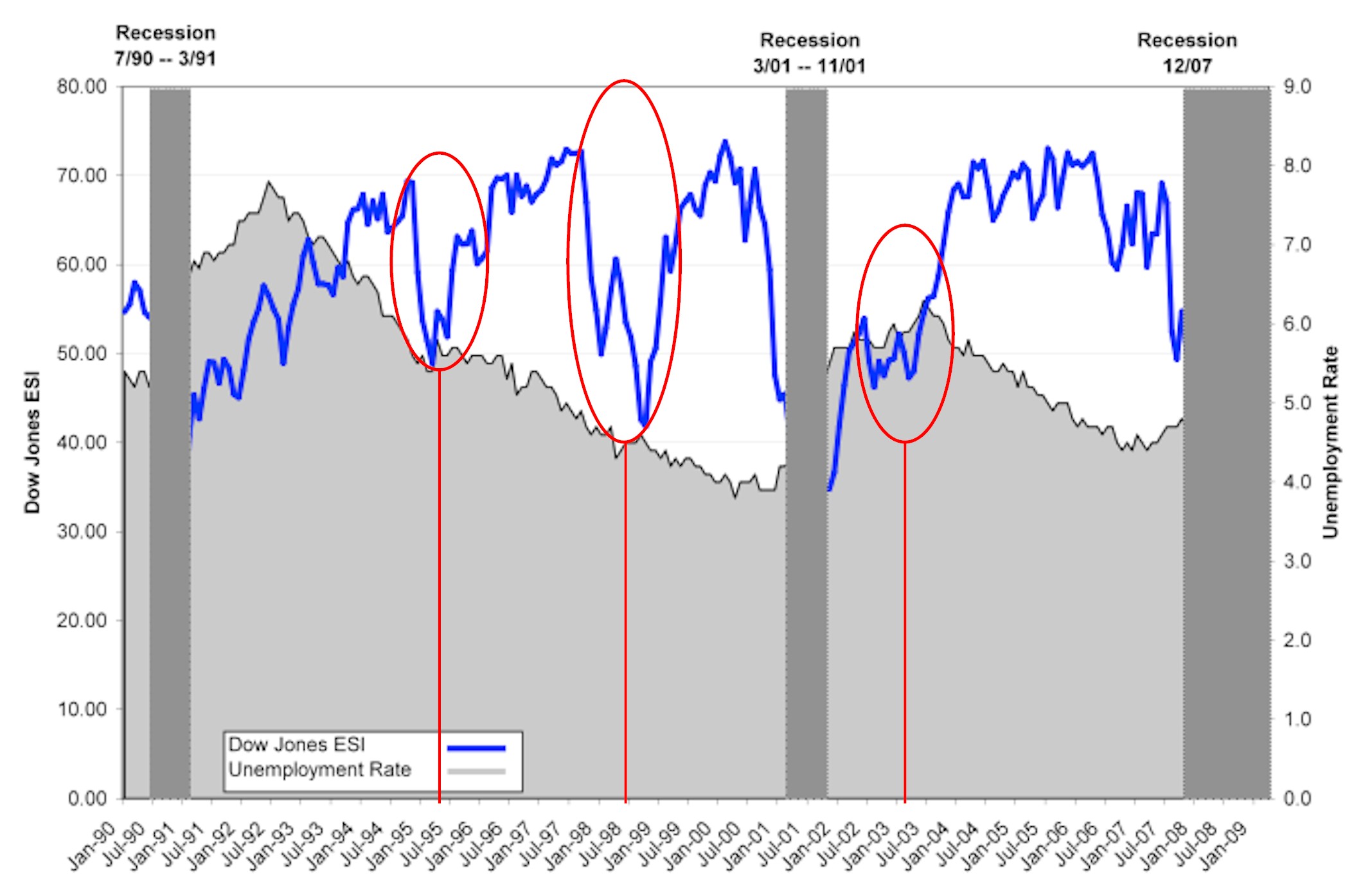

Recent Business Cycles

|

Source: www.solutions.dowjones.com/ESI - reuse by permission only

The infrastructure of a virtual corporation can react more quickly, thus cutting the development cycles of systems that can garner revenues. In hind-sight, the latest economic expansion took hold in 2003. At the time however, pessimism reigned. It wasn't until 2005 that a manager was likely to secure funding for new initiatives. By August 2007, the debt markets stalled and many projects were abandoned in mid-stream. Even projects begun in 2005 were released with version 1.0 feature sets and did not reach maturity. Given the dramatic decline in revenues, most of these in-house systems lost support for continued development. This left users and clients with immature systems, strained support staff, and overall mediocre results. This scenario plays out in most industries and contributes to the lack of overall progress towards the goals of reliable and user-accessible platforms. |

Continue: